san francisco gross receipts tax instructions 2020

For entities and combined groups with San Francisco-sourced gross annual receipts of over 50 million the Homelessness Gross Receipts Tax imposes an additional rate. 3 For the business activity of wholesale trade for tax years beginning on or after January 1 2021.

California High Court Lets San Francisco S Disputed Homeless Tax Stand Courthouse News Service

Your eight 8 character Online PIN.

. Businesses operating in San Francisco pay business taxes primarily based on gross receipts. In addition to the gross receipts tax San Francisco requires payment of a business registration fee. 1 Taxpayers can request a 60-day extension if they file the request in writing and pay at least 100 of the tax due by the filing deadline.

San Franciscos 2019 gross receipts tax and payroll expense tax are due on or before March 2 2020. The last four 4 digits of your Tax Identification Number. Tax and homelessness gross receipts tax that would otherwise be due on april 30 2020 are waived for taxpayers or combined groups that had combined san francisco gross receipts in calendar year 2019 of 10000000 or less.

0224 eg 224 per 1000 for taxable gross receipts over 25000000. F The amount of gross receipts from certain services activities subject to the gross receipts tax shall be the total amount determined under Section 9562. Instructions for Reporting 2020 Gross Receipts Click here link is external to begin.

Free shipping on qualified orders. Your seven 7 digit Business Account Number. Lean more on how to submit these installments online to comply with the Citys business and tax regulation.

Health and Homelessness Parks and Streets Bond. Your seven 7 digit Business Account Number The last four 4 digits of your Tax. Proposition F fully repeals the Payroll Expense Tax and increases the Gross Receipts Tax rates across most industries while providing relief to certain industries and small businesses.

And Miscellaneous Business Activities. No Matter What Your Tax Situation Is TurboTax Self-Employed Has You Covered. In other news the San Francisco Director of Elections has assigned labels to two propositions that will appear on the November 2020 ballot related to the San Franciscos gross-receipts tax on businesses operating in the city see Tax Alert 2020-2107.

Easy Fast Secure. Administrative and Support Services. Of San Francisco v.

Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. The San Francisco Office of the Treasurer and Tax. San Franciscos 2020 Ballot will include five tax and bond measures which if passed would provide for a total of 980 million in debt service for bonds and tax increases of approximately 401 to 481 million annually each discussed in greater detail below.

If you pay over a certain amount in payroll expense or earn a certain amount in gross receipts you must submit a final payroll expense and gross receipts tax filing with payment to ttx. Gross Receipts Tax Applicable to Construction. Enter your login information which was provided in letter you recently received from our office.

Gross Receipts Tax Applicable to Private Education and Health Services. San Franciscos 2019 gross receipts tax and payroll expense tax are due on or before March 2 2020. Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments.

The Gross Receipts Tax is a graduated percentage depending on the activity code your business falls under in the NAICS system. To begin filing your 2020 Annual Business Tax Returns please enter. 0105 eg 105 per 1000 for taxable gross receipts between 0 and 1000000.

1 The existing payroll expense tax is being phased out in increments consistent with the phase-in of the gross receipts tax over a. Ad Enjoy low prices on earths biggest selection of books electronics home apparel more. The Business Tax Overhaul proposal which seeks to reform the citys current business tax regime will appear on.

Free easy returns on millions of items. Over the next few years the City will phase in the Gross Receipts Tax and reduce the Payroll Expense Tax. In November of 2020 San Francisco voted to increase Gross Receipt Tax rates in a shift to do away with the payroll tax and slowly increase GRT by 40 in all industries up to 104 for some categories.

Ad Uncover Business Expenses You May Not Know About And Keep More Of The Money You Earn. The San Francisco Office of the Treasurer and Tax Collector Tax Collector has released a form for taxpayers to request a two-month extension of time to file their Gross Receipts Tax. Annual Business Tax Return Instructions 2021 The San Francisco Annual Business Tax.

Taxpayers must register or. Easy Fast Secure. Do Your 2021 2020 any past year return online Past Tax Free to Try.

The City began making the transition to a Gross Receipts Tax from a Payroll Tax based on wages paid to employees in 2014. The changes are reflected in the 2021 Annual Business Tax filings due February. Gross Receipts Tax Applicable to Financial Services.

And Professional Scientific and Technical Services. Ad Do Your 2021 2020 2019 2018 Taxes in Mins Past Tax Free to Try.

The Downturn Persists Examiner Analysis Reveals That S F S Economy Has A Long Road To Recovery Archives Sfexaminer Com

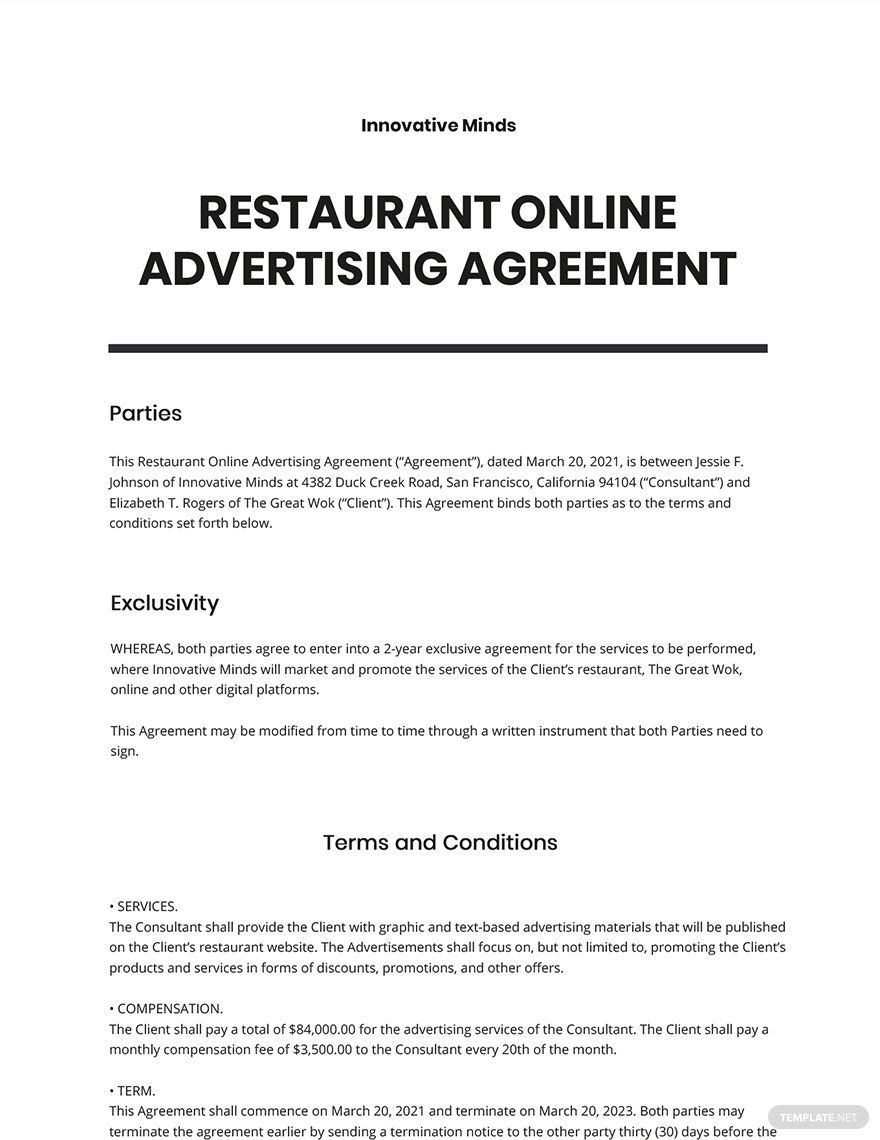

Restaurant Agreements Templates Word Format Free Download Template Net

Reporting Specialist Resume Samples Velvet Jobs

Logistics Resume Samples Velvet Jobs

Switchboard Resume Samples Velvet Jobs

Hospital Unit Clerk Resume 20 Guides Examples

Investment Associate Resume Samples Velvet Jobs

Revenue Manager Resume Samples Velvet Jobs

Painting Contract Free Contract For Services Template With Sample Power Of Attorney Form Contract Template Proposal Templates

Fill Free Fillable Forms For The State Of California

San Francisco Taxes Filings Due February 28 2022 Pwc

Employee Retention Tax Credit Office Of Economic And Workforce Development

Clerical Support Resume Samples Velvet Jobs

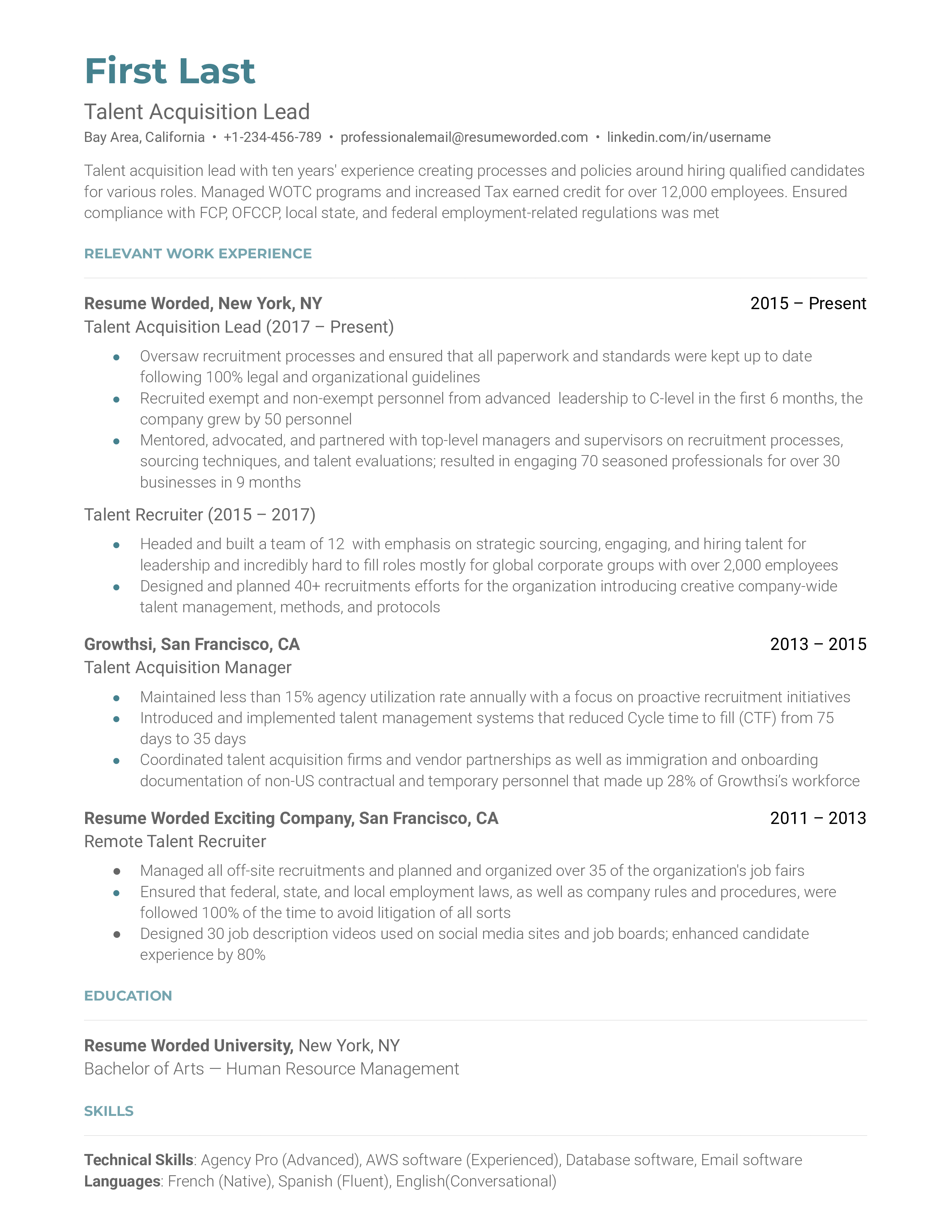

Human Resources Hr Administrator Resume Example For 2022 Resume Worded